Chris Barton, Banking and FinTech Partner Manager at Xero NZ, discusses Xero’s developments in the FinTech space:

Q: How does your job relate to the FinTech sector?

A: I work across the breadth of New Zealand’s financial industry to find solutions for Xero’s small business customers. Xero collaborates with banks, FinTechs, online lenders, and payment providers to solve common small business pain points such as accessing capital and making and receiving payments.

Q: What is Xero doing in the FinTech space?

A: Xero is very active in the FinTech industry, both at home and across the globe. Of the 700+ accredited apps in Xero’s marketplace the clear majority are FinTech by nature. Additionally, Xero’s ongoing investment into its API platform and open source philosophy means its 1.4m customers get access to more than 100,000 global developers all trying to find solutions for small business.

Xero will open a co-working space in Auckland in late 2018 with a strong Fintech focus. It also supports the FinTech industry through regular events, roadshows, fintech accelerators, and working with partner organisations to champion the FinTech industry, including attending London Fintech Week with the FinTechNZ trade delegation.

Q: How do you see financial services changing in the next five years?

A: The evolution of financial services over the next few years will see more automation and AI in customer service, identity verification solutions will become more ubiquitous and there will be a lot more FinTech and bank partnerships. We will also see more banks and FinTechs lending to small businesses. As data becomes more accessible we will see an increase in competition, and more consumer choice.

Five years is a long time in the FinTech world so a major disruption we haven’t foreseen yet could change everything. For example, there is a high possibility that one or more of the mega-platforms will develop a financial services offering; and a big question remains around how FinTechs and banks will respond to this new vertical.

About Xero:

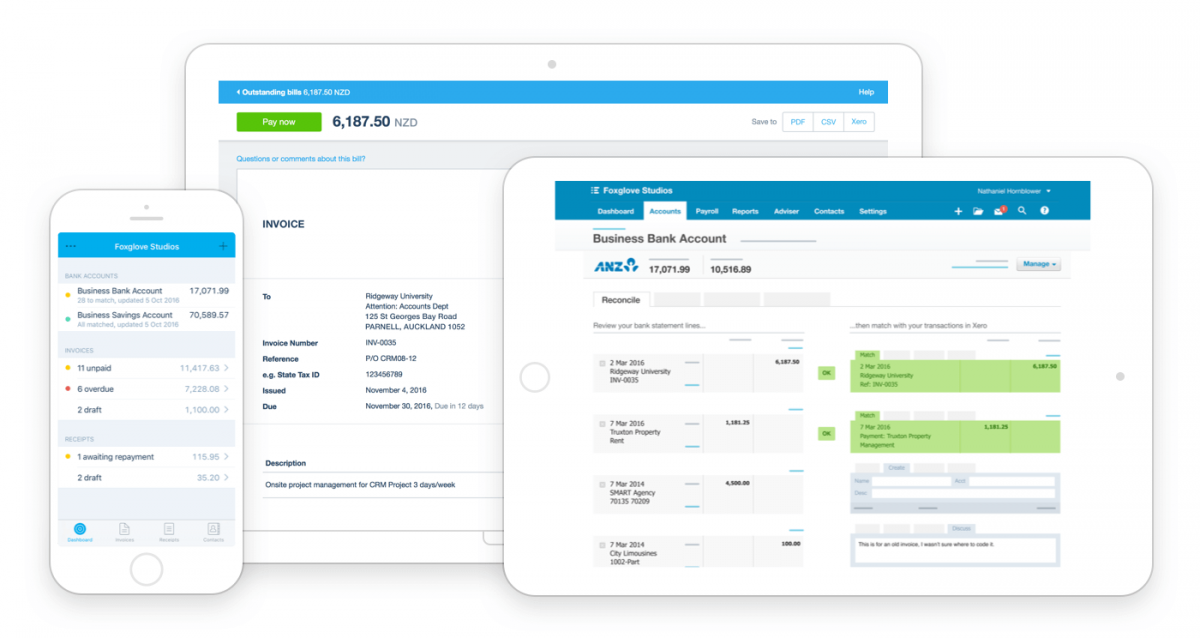

Xero is a beautiful, easy-to-use global online platform for small businesses and their advisors. The company has 1.4 million subscribers in more than 180 countries. Xero seamlessly integrates with more than 600 apps. It was ranked No. 1 by Forbes as the World’s Most Innovative Growth Company for two years running, won Technology Provider of the Year for the British Small Business Awards, and was rated by Canstar Blue as Australia’s best accounting software three consecutive years from 2015-2017.

Quick Facts:

• Xero has 1.4 million subscribers in more than 180 countries

• Xero seamlessly integrates with more than 700 apps globally

• Xero’s mission is to rewire the global economy, connecting millions of businesses to their advisors, banks and each other